The IRS is offering a final chance for some Americans to claim a $1,400 stimulus check. However, the clock is ticking—April 15 is the deadline to apply for this aid, and many eligible people might miss out if they don’t act fast.

If you haven’t received your $1,400 stimulus check yet, this is the last opportunity to apply, but it’s essential to understand who qualifies and how to claim the payment. Here’s what you need to know to make sure you don’t miss out on the funds you could be entitled to.

What is the $1,400 Stimulus Check?

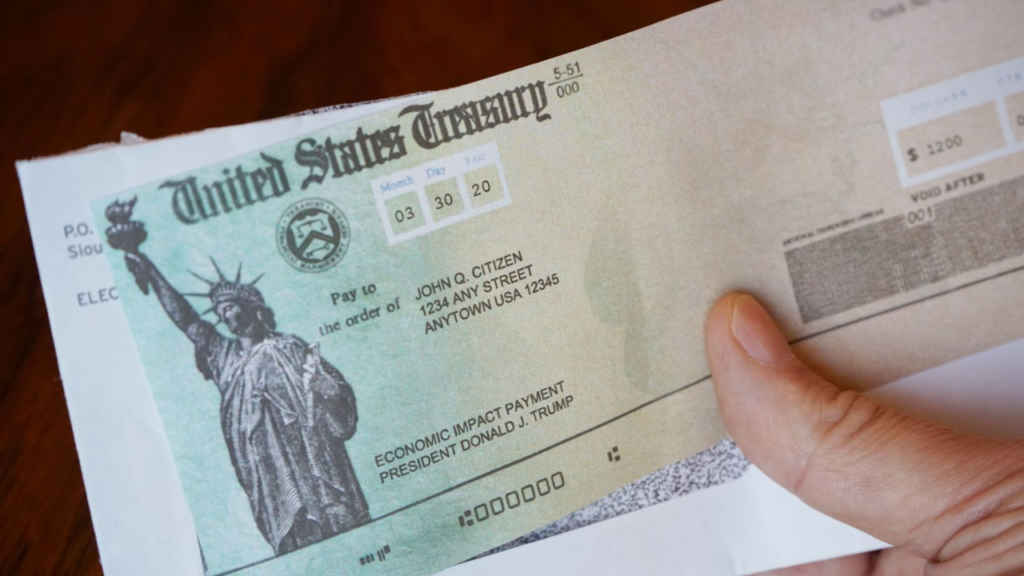

The $1,400 stimulus check is part of the COVID-19 relief efforts by the U.S. government. This payment was authorized by the American Rescue Plan, aimed at helping people financially recover from the pandemic’s economic impact.

For most people, this check was either directly deposited or sent by mail back in 2021 or 2022. However, some individuals didn’t receive it or didn’t claim it at the time. This is the last chance for those individuals to get the money they’re owed.

Who is Eligible for the $1,400 Stimulus Check?

You may be eligible for the $1,400 check if you meet the following criteria:

- You were eligible for the original payments: This includes U.S. citizens, permanent residents, or qualifying resident aliens who did not receive their full stimulus amount.

- Your income meets the requirements: If your income was too high in 2021 to receive the stimulus payments, you may still qualify for the payment based on your 2022 income. For most individuals, the threshold is $75,000. For married couples, it’s $150,000. The payment phases out gradually for those making more than these amounts.

- You have a dependent: If you claimed dependents on your tax returns, you could be eligible for additional payments. Each dependent can add to the amount you receive.

- You are a non-filer: If you didn’t file taxes in 2021 or 2022, you may still be eligible for the stimulus check. The IRS is encouraging people in this situation to submit a 2022 tax return or use the non-filer tool on the IRS website to apply.

How to Claim the $1,400 Stimulus Check?

The IRS has made it easy for people to apply for the stimulus check by either filing their taxes for the 2022 year or using the online non-filer tool. Here are the steps:

- File your tax return for 2022: If you haven’t done so already, file your taxes for 2022, even if you don’t owe anything or typically don’t file. You can file electronically using tax preparation software or through a tax professional. The IRS uses your 2022 tax return to determine eligibility for this payment.

- Use the IRS non-filer tool: If you don’t usually file taxes, you can use the IRS’s non-filer tool to apply for the payment. This tool is designed for individuals who don’t need to file a full tax return but want to receive the stimulus check.

- Check your payment status: After submitting your claim, you can track the status of your payment using the IRS’s “Get My Payment” tool. This allows you to see if your payment is processed or if there are any issues with your claim.

- Act before the April 15 deadline: Time is running out. The April 15 deadline is the last day to apply for this check, and the IRS will stop processing new claims after this date.

Why is This the Last Chance?

This final opportunity is based on the IRS’s deadline for 2022 tax filings. After April 15, the IRS will close the window for late claims, and you will no longer be able to receive the $1,400 stimulus check.

The IRS has emphasized that there will be no further extensions or opportunities for people to claim this check after the deadline.

What Happens if You Miss the Deadline?

If you miss the April 15 deadline, you won’t be able to claim your $1,400 stimulus payment. However, you might still be able to claim the payment on your next year’s taxes, but that would depend on the specific tax laws in place at the time.

While the government has made every effort to ensure that most people receive their stimulus checks, many individuals, especially those who didn’t file taxes or missed the original payment, have been left out. This final round of claims is the last chance to get the money owed to you.

What Should You Do if You’re Having Trouble Claiming?

If you are facing issues claiming your payment, whether due to missing tax returns or technical difficulties, the IRS offers resources to help.

You can contact the IRS helpdesk or visit their website to get more information and assistance. Tax professionals can also help ensure your claim is processed correctly.

Why Should You Act Quickly?

The IRS has stated that once the April 15 deadline passes, there will be no further extensions. Therefore, it’s important to act now to avoid missing out on the money that’s rightfully yours.

The process of filing a tax return or using the non-filer tool is straightforward, but don’t delay. Make sure you get your claim in on time.

Conclusion

The IRS is offering one final chance to claim the $1,400 stimulus check, but the April 15 deadline is fast approaching. If you believe you are eligible but haven’t yet received your payment, it’s essential to file your 2022 tax return or use the non-filer tool by the deadline.

Don’t miss this last opportunity to get the financial assistance you’re entitled to. Remember to act quickly, as after April 15, the window will close, and no further claims will be accepted.

Deepak Grover is a dedicated content writer at OTE News, specializing in government affairs, public policy, and current events. With a keen eye for detail and a passion for factual reporting, he ensures readers receive accurate and insightful news. Deepak holds a degree in Political Science and has experience in research-driven journalism.

When not writing, he enjoys reading historical books, exploring hiking trails, and staying updated with global political trends. His commitment to ethical journalism makes him a trusted voice at OTE News.