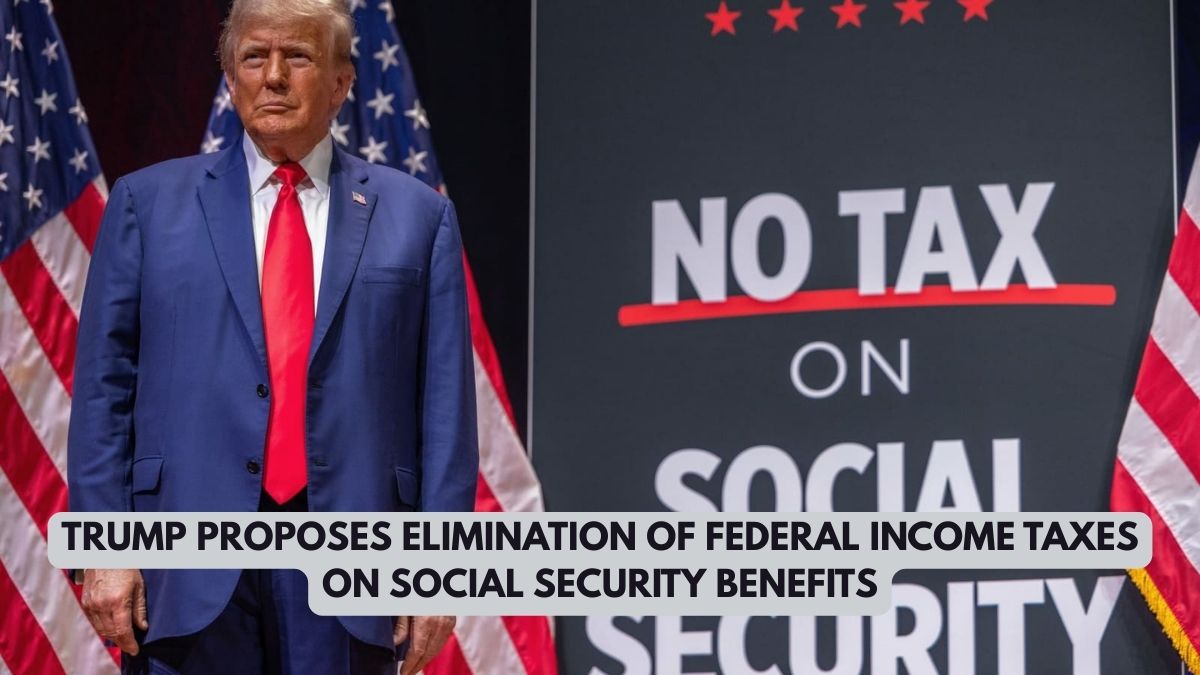

In a move that could significantly alter the financial landscape for millions of retirees, former President Donald Trump has proposed eliminating federal income taxes on Social Security benefits. If enacted, the plan could deliver substantial savings to senior citizens—but at a high cost to federal revenues and the long-term stability of the Social Security and Medicare systems.

What Does Trump’s Plan Propose?

Currently, up to 85% of Social Security benefits can be taxed by the federal government depending on a retiree’s income. These taxes were first introduced in the 1980s to help fund Social Security, which many consider one of the most crucial pillars of America’s retirement system.

Trump’s proposal is part of a broader tax reform effort that includes exempting not only Social Security benefits but also tips and overtime wages from taxation. This package aims to deliver direct relief to working-class Americans and retirees alike.

Potential Benefits for Retirees

The biggest winners under Trump’s plan would be retirees who currently pay taxes on their benefits. According to Nasdaq, the average senior household could save as much as $3,082 annually if Social Security income becomes tax-exempt (Nasdaq Report).

Additionally, seniors would benefit from simplified tax filing. Without the need to calculate taxable portions of their benefits, retirees could enjoy a more straightforward process with fewer complications during tax season.

The Cost to the Government—and the Risk to Social Security’s Future

While the plan may bring joy to retirees, it could present serious challenges to the federal budget. According to the Tax Foundation, eliminating taxes on Social Security benefits could cost the federal government approximately $1.4 trillion over 10 years (Tax Foundation Analysis).

This is especially concerning in light of Social Security’s already troubled outlook. A report by Axios notes that the trust fund is projected to run dry by 2034 under current conditions—but with the tax cut, insolvency could happen as early as 2031 (Axios Newsletter).

In such a scenario, without new revenue or spending cuts, Social Security may only be able to pay out about 77% of scheduled benefits.

Who Really Benefits?

Critics argue that the proposal disproportionately helps wealthier seniors. The Tax Policy Center estimates that while high-income households could see tax reductions of nearly $2,500, low-income seniors—who generally don’t pay taxes on Social Security—would see minimal benefit (Kiplinger Report).

President Biden has already pushed back on Trump’s plan, accusing him and others of attempting to “take a hatchet to Social Security,” during a campaign stop earlier this month (The Guardian).

Legislative Efforts Underway

Trump’s campaign is not the only vehicle for this proposal. Representative Thomas Massie (R-KY) has introduced legislation aimed at repealing the federal tax on Social Security benefits. The bill has garnered attention in conservative circles, but its path through Congress remains uncertain.

For updates on the legislative process, refer to the U.S. Congress official website.

Final Thoughts

Trump’s proposal taps into a popular idea among aging Americans: letting retirees keep more of their benefits. However, without a clear replacement for the lost tax revenue, critics warn that the plan could endanger the very program it seeks to protect.

With Social Security already facing financial strain, this proposal has reignited the debate between delivering immediate financial relief and ensuring long-term sustainability. As the 2024 election cycle heats up, this issue will likely remain at the forefront of policy discussions.

This article has been carefully fact-checked by our editorial team to ensure accuracy and eliminate any misleading information. We are committed to maintaining the highest standards of integrity in our content.

Deepak Grover is a dedicated content writer at OTE News, specializing in government affairs, public policy, and current events. With a keen eye for detail and a passion for factual reporting, he ensures readers receive accurate and insightful news. Deepak holds a degree in Political Science and has experience in research-driven journalism.

When not writing, he enjoys reading historical books, exploring hiking trails, and staying updated with global political trends. His commitment to ethical journalism makes him a trusted voice at OTE News.